What is banner Aetna?

Banner|Aetna, a joint health insurance venture owned by Banner Health and Aetna, is entering a partnership with Virta Health, a company that offers personalized treatment for those with type 2 diabetes. To Continue Reading... Subscribe and get unlimited access to this content.

Does Banner Health accept Medicare?

With Banner Medicare Advantage, you can choose between a Medicare Advantage Part C Health Maintenance Organization (HMO) plan and a Medicare Advantage Part C Preferred Provider Organization (PPO) plan. We provide all the services under Medicare Parts A and B of traditional Medicare, as well as provide Medicare Part D Prescription Drug coverage.

Do you have a patient portal?

Yes we have a patient portal. You can schedule appointments, access lab results, request refills, view medical records, and send messages directly to your provider. You can learn more here.

How many employees does Banner Health have?

With more than 50,000 employees, Banner Health is the largest private employer in Arizona and third largest employer in the Northern Colorado front range area. We offer comprehensive services, physician services, hospice and home care. Our research is internationally recognized.

Is Aetna the same as banner Aetna?

Banner|Aetna is an affiliate of Banner Health and of Aetna Life Insurance Company and its affiliates (Aetna). Each insurer has sole financial responsibility for its own products. Aetna and Banner Health provide certain management services to Banner|Aetna.

Is Banner Health part of Aetna?

The partnership with Banner is Aetna's third joint venture with a nationally recognized health system, as it moves 75 percent of its contracts to value-based care models by 2020. Currently, Banner provides nearly four million care interactions in Maricopa County annually.

Does Banner Health have an app?

Download the Banner Health App. Having this information at your fingertips makes managing your health easier. And, with our app available in the Apple App or Google Play stores, you can have all this important information with you at all times.

Does Aetna have a copay?

Outpatient services Office& other outpatient services: $20 copay/visit, deductible applies Office & other outpatient services: 90% coinsurance None Inpatient services 20% coinsurance after $250 copay/stay 90% coinsurance after $290 copay/stay Penalty of $500 for failure to obtain pre- authorization for out-of-network ...

What type of insurance is Aetna Medicare?

Aetna Medicare is a HMO, PPO plan with a Medicare contract. Our SNPs also have contracts with State Medicaid programs. Enrollment in our plans depends on contract renewal.

What does Aetna stand for?

AetnaTypeSubsidiaryIndustryManaged health careFoundedMay 28, 1853 (as Aetna Life Insurance Company)FounderEliphalet Adams BulkeleyHeadquartersHartford, Connecticut, U.S.10 more rows

How do I log into my banner?

Visit the student Banner page. Click the Login to Banner (SSB) link on the left side. Click the Log in to Banner link. In the User ID box, enter your Banner ID.

What EHR does Banner Health use?

Electronic Health Records Banner Health Network has two preferred platforms when it comes to EHRs—eClinicalWorks and Cerner Ambulatory.

How many locations does Banner Health have?

30 hospitalsRegarded and recognized as a top health system in the country for the clinical quality consistently provided to patients in our hospitals, nonprofit Banner Health is headquartered in Phoenix, Arizona, and operates 30 hospitals, including three academic medical centers and other related health entities and services in ...

Is it better to have a deductible or copay?

Copays are a fixed fee you pay when you receive covered care like an office visit or pick up prescription drugs. A deductible is the amount of money you must pay out-of-pocket toward covered benefits before your health insurance company starts paying. In most cases your copay will not go toward your deductible.

Which is better PPO or HMO?

HMO plans typically have lower monthly premiums. You can also expect to pay less out of pocket. PPOs tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. Out-of-pocket medical costs can also run higher with a PPO plan.

What does 80% coinsurance mean?

One definition of “coinsurance” is used interchangeably with the word “co-pay” – the amount the insurance company pays in a claim. An eighty- percent co-pay (or coinsurance) clause in health insurance means the insurance company pays 80% of the bill. A $1,000 doctor's bill would be paid at 80%, or $800.

Looking for care?

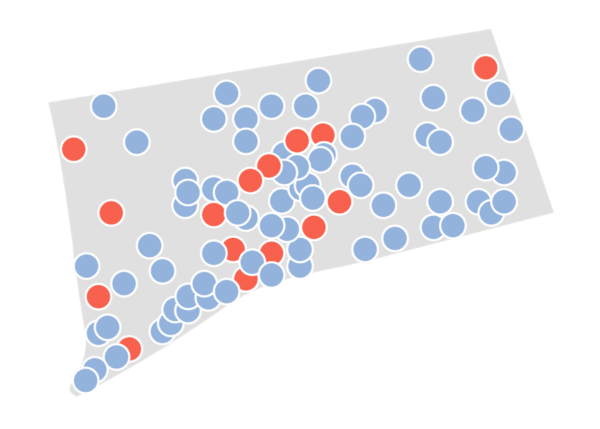

Choose the right type of plan associated with your coverage below to search for health care providers that accept it.

Transforming health care, together

Banner|Aetna aims to offer more efficient and effective member care at a more affordable cost. We join the right medical professionals with the right technology, so members benefit from quality, personalized health care designed to help them reach their health ambitions.

Popular Posts:

- 1. st vincent's patient portal

- 2. dana farber patient portal sign in

- 3. patient portal premier

- 4. my borgess health patient portal

- 5. highland patient portal

- 6. valley wide health systems patient portal

- 7. crmg patient portal

- 8. genesis healthcare patient portal

- 9. iu west patient portal

- 10. mount ascutney hospital patient portal